UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

¨☐ Preliminary Proxy Statement

¨☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x☒ Definitive Proxy Statement

¨☐ Definitive Additional Materials

¨☐ Soliciting Material Pursuant to § 240.14a-12

CATHAY GENERAL BANCORP

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: | |

|

| ||||

| ||||

To Our Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Cathay General Bancorp. The annual meeting will be held on Monday, May 16, 2016,2022, at 5:00 p.m., local time, at 9650 Flair Drive, El Monte, California 91731.Pacific Time. In light of public health concerns regarding the COVID-19 pandemic and to support the health and well-being of our employees, directors, stockholders and the community, the annual meeting will be held exclusively in a virtual format. You will be able to vote and submit questions electronically but will not be able to attend in person.

At the annual meeting, you will be asked to elect four Class II directors to serve until 2019, tothe 2025 annual meeting of stockholders, vote on an advisory (non-binding) proposalresolution to approve our executive compensation, and to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 20162022 fiscal year.year, all as further described in the accompanying proxy statement.

Your vote is very important. Whether or not you expect to attend the annual meeting in person,remotely, we encourage you to cast your vote via the Internet, by telephone, or if you prefer, by completing, signing, and returning your proxy card in the accompanying return envelope. Specific instructions for voting via the Internet or by telephone are stated on the proxy card. If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from them to vote your shares. Your cooperation is appreciated since aA majority of the outstanding shares of our common stock must be represented, either in person or by proxy, for us to transact business at the annual meeting.

We look forward to seeing you at the meeting.

Sincerely yours, Your cooperation is much appreciated.

Sincerely yours, | ||

| ||

Dunson K. Cheng Executive Chairman of the Board |

Dunson K. Cheng

Chairman of the Board,

President, and Chief Executive Officer

Los Angeles, California

April 14, 2016

| ||||

| ||||

Notice of Annual Meeting of Stockholders

to be Held on May 16, 20167, 2022

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2022

To The Stockholders of Cathay General Bancorp:

Notice is hereby given that the annual meeting of stockholders of Cathay General Bancorp will be held on Monday, May 16, 2016,2022, at 5:00 p.m., local time, at our offices located at 9650 Flair Drive, El Monte, California 91731,Pacific Time, for the following purposes:purposes, as more fully described in the accompanying proxy statement:

1. | To elect four Class II directors to serve until the |

2. | To vote on an advisory (non-binding) |

3. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the |

4. | To transact such other business as may properly be brought before the annual meeting or any adjournments or postponements of the annual meeting. |

Due to the COVID-19 pandemic, the annual meeting will be held exclusively by means of remote communication in a virtual format. You will be able to vote and submit questions electronically during the annual meeting. To be admitted to the annual meeting at www.virtualshareholdermeeting.com/CATY2022, you must enter the control number on your proxy card.

The Board of Directors has fixed April 1, 2016,March 25, 2022, as the record date for the annual meeting. Only holders of record of our common stock at the close of business on the record date are entitled to receive notice of and to vote at the annual meeting.

Please cast your vote via the Internet, by telephone, or by completing, signing, and returning your proxy card in the accompanying return envelope. If you mail the envelope in the United States, it does not require postage. If you attend the annual meeting remotely, you may choose to vote at the annual meeting by following the instructions available on the meeting website. If you do so, your prior voting instructions, if any, will be disregarded. It is important that you vote promptly via the Internet, by telephone, or by returning your proxy card promptlyprior to the annual meeting even if you plan to attend the annual meeting in person.remotely.

We invite you to attend the meeting in person. If you attend, you may choose to vote in person at the meeting. If you do so, your prior voting instructions will be disregarded.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May16, |

By Order of the Board of Directors,

Lisa L. Kim

By Order of the Board of Directors,  May K. Chan Secretary |

Los Angeles, California

April 14, 2016

i

This summary highlights information contained elsewhere in this proxy statement. This summary is designed as an aid and does not contain all of the information that you should consider in deciding how to vote. As such, you should read this entire proxy statement carefully before voting.

Annual Meeting of Stockholders

Date and Time: Record Date: | Monday, May 16, 5:00 p.m.,

| March 25, 2022 | Place: | Due to the COVID-19 pandemic, the annual meeting will be held exclusively in a virtual format. To be admitted to the annual meeting at www.virtualshareholdermeeting.com/CATY2022 you must enter the control number on your proxy card. | ||

| ||||||

Voting: | Holders of record of our common stock at the close of business on the record date. | Attendance: | Stockholders as of the record date and their duly appointed proxies may attend the |

Proposals and Voting Recommendations

Proposal | Board Recommendation | Page | ||

1. Election of Directors | FOR EACH NOMINEE | 5 | ||

2. Advisory (Non-Binding) Vote to Approve our Executive Compensation | FOR | 38 | ||

3. Ratification of the Appointment of Independent Registered Public Accounting Firm | FOR | 39 |

Proposal One—PROPOSAL ONE—Election of Directors

The first proposal is to elect four Class II directors to serve until the 20192025 annual meeting of stockholders and their successors have been elected and qualified. The following table provides summary information about each nominee.

Name of Nominee | Age | Principal Occupation | Director Since | Age | Principal Occupation | Director | |||||||||

Kelly L. Chan | 69 | Certified Public Accountant | 1990 | 75 | VP of Finance, Phoenix Bakery Inc., and Certified Public Accountant | 1990 | |||||||||

Dunson K. Cheng | 71 | Chairman of the Board, President, and Chief Executive Officer of Cathay General Bancorp and Chairman of the Board and Chief Executive Officer of Cathay Bank | 1990 | 77 | Executive Chairman of the Board of Cathay General Bancorp and Cathay Bank | 1990 | |||||||||

Thomas C.T. Chiu | 68 | Medical Doctor | 2003 | ||||||||||||

Chang M. Liu | 55 | President and Chief Executive Officer of Cathay General Bancorp and Cathay Bank | 2020 | ||||||||||||

Joseph C.H. Poon | 69 | President of Edward Properties, LLC | 1990 | 75 | President of Edward Properties, LLC | 1990 | |||||||||

Proposal Two—

PROPOSAL TWO—Advisory (Non-Binding) Vote to Approve our Executive Compensation

Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), enables our stockholders to vote to approve, on a non-binding basis, the compensation of our Named Executive Officers, as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission.Commission (the “SEC”). Accordingly, the Board of Directors is submitting the following proposalresolution for stockholder consideration:

“RESOLVED, that the compensation paid to our Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables, and any related material disclosed in this proxy statement, is hereby APPROVED.”

Proposal Three—

PROPOSAL THREE —Ratification of the Appointment of Independent Registered Public Accounting Firm

We are asking our stockholders to ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for our 20162022 fiscal year. Although ratification is not legally required, we are submitting the appointment of KPMG to our stockholders for ratification in the interest of good corporate governance. In the event that this appointment is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

ii

| ||||

| ||||

Proxy Statement

Annual Meeting of Stockholders

MayMAY 16, 20162022

The Board of Directors of Cathay General Bancorp (the “Board”) is furnishing this proxy statement to the holders of record of our common stock to solicit proxies for use at our 20162022 annual meeting of stockholders and any adjournments or postponements of the annual meeting. In this proxy statement, “Bancorp,” the “Company,” “we,” “us,” and “our” refer to Cathay General Bancorp, a Delaware corporation. This proxy statement and the enclosed proxy card were first mailed to stockholders on or about April 14, 2016.7, 2022.

INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of the annual meeting?At the annual meeting, our stockholders will be asked to:

1. | Elect four Class II directors to serve until the |

2. | Vote on an advisory (non-binding) |

3. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the |

4. | Transact such other business as may properly be brought before the annual meeting or any adjournments or postponements of the annual meeting. |

When and where will the annual meeting be held? The annual meeting will be held on May 16, 2016,2022, at 5:00 p.m., local time, at our offices located at 9650 Flair Drive, El Monte, California 91731.Pacific Time. Due to the COVID-19 pandemic, the annual meeting will be held exclusively in a virtual format. You will be able to attend the meeting in person via the Internet, vote, and submit questions online during the annual meeting by visiting www.virtualshareholdermeeting.com/CATY2022.

Who can attend the annual meeting?meeting via the Internet? All stockholders at the close of business on the record date and their duly appointed proxies may attend the meeting.annual meeting in person via the Internet. To be admitted to the annual meeting via the Internet, you must enter the control number on your proxy card.

INFORMATION ABOUT VOTING AND PROXIES

Who is entitled to vote at the annual meeting?The Board has fixed April 1, 2016,March 25, 2022, as the record date for the annual meeting. Only holders of record of our common stock at the close of business on the record date are entitled to receive notice of and to vote at the annual meeting. On the record date, 78,836,72875,078,258 shares of our common stock were outstanding.

How many shares must be present to transact business at the annual meeting?A quorum is required for our stockholders to transact business at the annual meeting. The presence in person or by proxy of the holders of a majority of the outstanding shares of our common stock is necessary to transact business at the meeting. Abstentionsconstitutes a quorum. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” and broker non-votes will be counted as present for this purpose.towards determining whether or not a quorum is present. If the shares represented at the annual meeting are not sufficient to transact business,constitute a quorum, we may adjourn or

postpone the annual meeting to permit the further solicitation of proxies.

What are broker non-votes?The term “broker non-votes” generally refers to shares that are held by a broker or other nominee in its name for the benefit of its clients but that cannot be voted because the broker or nominee is precluded from voting on certain matters and has not received voting instructions from the beneficial owner on those matters.

How many votes am I entitled to?Each stockholder of record is entitled to one vote for each share of our common stock registered in the stockholder’s name. Shares may not be voted cumulatively for the election of directors or otherwise.

What is the difference between a “stockholder“stockholder of record”record” and a “beneficial“beneficial owner?”These terms describe how your shares are held. If your shares are registered directly in your name with our transfer agent, then you are a “stockholder of record” of those shares. As a stockholder of record, you have the right to vote by proxy via the Internet, by telephone, by proxy,mail, or in person via the Internet at the annual meeting.

If your shares are held in an account by a broker, bank, trust company, or other similar organization, then you are a “beneficial owner” of those shares and the organization holding your shares is considered the “stockholder of record” for purposes of voting at the annual meeting. If you are a beneficial owner, you have the right to direct the organization holding your shares on how to vote the shares held in your account.

How do I vote my shares?If you are a stockholder of record, youthere are four ways to vote:

By Internet Before the Annual Meeting Date. You may vote your shares by telephone,proxy via the Internet before the annual meeting date by completingfollowing the enclosedinstructions provided in the proxy card.

By Telephone. You may vote by proxy by calling the toll free number on the proxy card.

By Mail. You may vote by proxy by filling out the proxy card and returning it signed and dated in the enclosed postage-prepaid envelope, or by attending the meeting and voting in person. envelope.

• | By Internet During the Annual Meeting. You may attend the annual meeting in person via the internet on May 16, 2022, at 5:00 p.m. Pacific Time by visiting www.virtualshareholdermeeting.com/CATY2022 and you can vote during the annual meeting using the control number on your proxy card. |

If you vote via the Internet, by telephone, or properly complete and mail the proxy card, and we receive it on or before the voting date, your shares will be voted as you direct. Even if you plan to attend the annual meeting in person via the Internet, we encourage you to cast your vote before the annual meeting via the Internet, by telephone, or if you prefer, by completing, signing, dating, and returning the proxy card. Specific instructions for voting by telephone are stated on the proxy card.

If you are a beneficial owner you have the right to direct the organization holdingand your shares on howare held in a brokerage account or by a bank or other nominee, your ability to vote by telephone or the Internet depends on your broker’s voting process. Please follow the directions provided to you by your broker, bank or nominee.

What are broker non-votes? The term “broker non-votes” generally refers to shares that are held by a broker or other nominee in your account. If you wish to vote in person atits name for the meeting, you must obtain a valid proxybenefit of its clients but that cannot be voted because the broker or nominee is precluded from voting on “non-routine matters” and has not received voting instructions from the organization holding the shares giving you the right to vote at the meeting. beneficial owner on those matters.

If you hold your shares in a brokerage account and do not give voting instructions to your broker on proposals that are considered “non-routine,” your broker cannot vote them for you and your shares will be treated as broker non-votes. At the annual meeting, Proposal Three (Ratification of the Appointment of Independent Registered Public Accounting Firm) involves matters that we believe will be considered “routine,” while Proposal One (Election of Directors) and Proposal Two (Advisory (Non-Binding) Vote to Approve Our Executive Compensation) involve matters that we believe will be considered “non-routine.”

Therefore, it is important that you provide voting instructions for all proposals.

What if I don’tdon’t vote for some of the items listed in this proxy statement?If you are a stockholder of record and return your signed proxy card, or vote via the Internet or by telephone, the proxy holders will vote your shares, with respect to the items without specific voting instructions, according to the recommendations of the Board. The Board has designated Heng W. Chen and Lisa L. Kim,May K. Chan, and each of them individually, with power of substitution, as proxy holders.

May I change my vote? Yes. If you are a stockholder of record, you may revoke your proxy at any time before it is exercised by filing a written notice of revocation with our Secretary, by delivering to our Secretary a later signed and dated proxy card, or by a later dated vote via the Internet or by telephone. The deadline to vote via the Internet or by telephone is 11:59 p.m., Eastern Time, on May 15, 2016.2022. You may also revoke your proxy if you are present atattend the annual meeting in person via the Internet and vote in person. Attendance atonline during the annual meeting will not cause any previously granted proxy to be revoked unless you specifically make that request.by following the website instructions. Unless you decide to attend the annual meeting in person via the Internet and vote in person,online at the annual meeting, we recommend that you change or revoke your prior instructions in the same manner as you originally gave them and provide enough time for the new voting instructions to reach us before the annual meeting begins. Once the annual meeting begins, you may only change or revoke your proxy in person.by voting online at the annual meeting by following the instructions available on the meeting website.

How are the shares held by the Cathay Bank Employee Stock Ownership Plan Trust (ESOPT)(the “ESOPT”) voted? Each participant of the Cathay Bank Employee Stock Ownership PlanESOPT has the power to direct the vote of the shares allocated to his or her account by providing voting instructions. Charles Schwab Bank, as Trustee of the ESOPT, will vote the shares allocated to a participant’s account as directed by the participant and, ifparticipant. If no direction is received by 11:59 p.m., Eastern Time, on May 11, 2022, with respect to any shares held by the ESOPT, the Trustee will vote such shares in the same proportion ofas the stockshares voted by the Trustee on any matter as to which it has received timely directions.

How does the Board recommend that I vote?The Board unanimously recommends that you vote your shares as follows:

• | FOR EACH NOMINEE as Class II directors as specified under Proposal |

• | FOR the advisory (non-binding) |

• | FOR ratification of the appointment of KPMG LLP as our independent registered public accounting firm as specified under Proposal Three. |

None of our directors havehas informed us in writing that he or she intends to oppose any action intended to be taken by us at the annual meeting.

What is the vote required to elect directors and approve the other proposals?

Proposal One (Election of Directors)

The nominees receiving a majority of votes cast at the annual meeting will be elected as directors. A majority of votes cast means the number of votes cast “for” the director’s election exceeds the number of votes cast “against” that director’s election. Abstentions and broker non-votes will not countbe counted as either “for” or “against” votes so abstentionscast for this purpose, and broker non-votes will have no effect on the election of a director. If an incumbent director nominee fails to receive the requisite vote in an uncontested election, that director must offer to resign. Our Nomination and Governance Committee and the Board will then act on the tendered offer to resign in the best interest of Bancorp.

Proposal Two (Advisory (Non-Binding) Vote to Approve our Executive Compensation)

The affirmative vote of a majority of our shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting is required to approve Proposal Two. Abstentions will be treated as present and entitled to vote and therefore will have the same effect as a vote against this proposal. Broker non-votes will not affect the outcome of the advisory vote. Although the vote is non-binding, the Board and our Compensation Committee will review the voting results in connection with their ongoing evaluation of the Company’s compensation program.

Proposal Three (Ratification of the Appointment of Independent Registered Public Accounting Firm)

The affirmative vote of a majority of our shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting is required to approve Proposal Three. Abstentions will be treated as present and entitled to vote and therefore will have the same effect as a vote against this proposal. Broker non-votesBrokers will have discretion to vote on this proposal. In the event stockholders do not affectratify the outcomeappointment, the appointment will be reconsidered by the Audit Committee and the Board. Even if the selection is ratified, the Audit Committee may in its discretion select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the vote.Company and our stockholders.

Who will serve as inspector of elections?The inspector of elections for the annual meeting will be a representative of American Stock Transfer and Trust Company,Elections Services, LLC. Under Delaware law, the inspector of elections will rule on the proxies and ballots submitted and may consider evidence deemed to be reliable to reconcile proxies and ballots submitted by or on behalf of banks, brokers, their nominees, or similar persons that represent more votes than the holder of a proxy is authorized by the stockholder of record to cast, or more votes than the stockholder holds of record.

What happens if additional matters are presented at the annual meeting or a nominee is unable to serve as a director?As of the date of this proxy statement, the Board knows of no matters to be brought before the annual meeting other than the proposals specifically listed in the notice of annual meeting of stockholders. Nevertheless, if further business is properly presented, the proxy holders named in the enclosed proxy card will vote the shares in their discretion in accordance with their best judgment.

If any nominee for director named in this proxy statement becomes unavailable for any reason, or if any vacancy on the Board occurs before the election, the shares represented by any proxy voting for that nominee will be voted for the person who may be designated by the Board to replace the nominee or to fill that vacancy on the Board. However, atas of the date of this proxy statement, the Board does not believe that any nominee will be unavailable or that any vacancy will occur.

How will proxies be solicited and who will pay for the solicitation? We will pay the cost of this solicitation of proxies. In addition to the use of the mail, the officers, directors, and employees of Bancorp and its subsidiaries may solicit proxies personally or by telephone, facsimile, or electronic means. These individuals will not be specially compensated for these solicitation activities. Arrangements will also be made with brokerage firms and certain other custodians, nominees, and fiduciaries for forwarding solicitation materials to the beneficial owners of shares held of record by these persons, and we will reimburse them for their reasonable expenses incurred in forwarding these materials.

What happens if the annual meeting is adjourned or postponed?Your proxy will remain valid and the shares may be voted at any adjourned annual meeting when resumed or at any postponed annual meeting. You will still be able to change your vote or revoke your proxy until the voting occurs.

Do I have rights or appraisal or similar rights of dissenters with respect to any matter to be acted upon at the annual meeting?None of the proposals to be acted upon at the annual meeting and discussed in this proxy statement carry rights of appraisal or similar rights of dissenters.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Based on the contents of reports filed with the Securities and Exchange Commission (“SEC”)SEC pursuant to Sections 13(d) and 13(g) of the Securities Exchange Act, of 1934, as amended (the “Exchange Act”), we believe the entities listed below are the only beneficial owners of more than five percent of our common stock as of April 1, 2016.March 25, 2022.

Name and Address of Beneficial Owner | AmountandNatureof | PercentageofCommon | ||||||||

BlackRock, Inc. | 8,843,149 2/ | |||||||||

55 East 52nd Street, New York, NY 10055 | ||||||||||

The Vanguard Group, Inc. | 7,295,565 3/ | |||||||||

100 Vanguard Blvd., Malvern, PA 19355 | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

1/ | The ownership percentage is determined by dividing the number of shares shown in this table by the |

2/ | All information regarding BlackRock, Inc. is based on an amendment to Schedule 13G filed with the SEC on January |

3/ | All information regarding The Vanguard Group, Inc. is based on an amendment to Schedule 13G filed with the SEC on February |

|

|

As of April 1, 2016,March 25, 2022, our directors, director nominees, and executive officers as a group beneficially owned 5,034,1973,229,968 shares of our common stock. The individual security ownership of our directors, director nominees, and named executive officers can be found in “Security Ownership of Nominees, Continuing Directors, and Named Executive Officers.” Our directors and executive officers have informed us that they intend to vote according to the recommendations of the Board.

As of April 1, 2016,March 25, 2022, the Cathay Bank Employee Stock Ownership Trust (the “ESOPT”)ESOPT held 957,052

716,642 shares of our common stock. All the shares of our common stock held by the ESOPT have been allocated among the participants of the Cathay Bank Employee Stock Ownership Plan. Charles Schwab Bank, as Trustee of the ESOPT, will vote the shares allocated to a participant’s account as directed by the participant and, if no direction is received, in the same proportion of the stock voted by the Trustee on any matter as to which it has received timely directions. If no direction is received by 11:59 p.m., Eastern Time, on May 11, 2022, with respect to any shares held by the ESOPT, the Trustee will vote such shares in the same proportion as the shares voted by the Trustee on any matter as to which it has received timely directions.

ELECTION OF DIRECTORS

Under our certificate of incorporation and bylaws, the Board may consist of between three and 25 directors, and the number of directors within thethis range may be changed from time to time by the Board. The Board currently consists of 12 directors, each of whom is also a director of Cathay Bank, a California-chartered bank and wholly-owned subsidiary of Bancorp.

The Board has three classes of directors and our bylaws provide that the number of directors in each class should be as nearly equal in number as possible. The term of office of each class of directors is three years. The current term of the Class II directors will expire at the 20162022 annual meeting of stockholders and, if elected at the 20162022 annual meeting, the new term will expire at the 20192025 annual meeting of stockholders. The current term of the Class III directors will expire at the 20172023 annual meeting of stockholders. The current term of the Class I directors will expire at the 20182024 annual meeting of stockholders.

Stockholders are being asked to elect four Class II directors. The Class II directors will hold office until the 20192025 annual meeting of stockholders and their successors have been elected and qualified. The Board, based on the recommendation of the Nomination and Governance Committee and the unanimous vote of all independent directors of the Board, has nominated Kelly L. Chan, Dunson K. Cheng, Thomas C.T. Chiu,Chang M. Liu, and Joseph C.H. Poon to serve as Class II directors. All of the nominees are currently directors of Bancorp and Cathay Bank, and have served continuously in these capacities since the dates indicated in the table in “Security Ownership of Nominees, Continuing Directors, and Named Executive Officers” below.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR EACH NOMINEE (KELLY L. CHAN, DUNSON K. CHENG, THOMAS C.T. CHIU,CHANG M. LIU, AND JOSEPH C.H. POON) AS CLASS II DIRECTORS.

Security Ownership of Nominees, Continuing Directors, and Named Executive Officers

The following table sets forth:

The age of each nominee and director and the periods each has served as a director of Bancorp.

Information on the beneficial ownership, as that term is defined under SEC rules and regulations, of shares of our common stock as of April 1, 2016,March 25, 2022, by each nominee and director, by each executive officer named in the “Summary Compensation Table” under “Remuneration of Executive Officers” (the “Named Executive Officers”), and by all nominees, directors, and executive officers as a group.

|

Each nominee, director, and executive officer has furnished the information on his or her own beneficial ownership set forth in the following table. Except as otherwise noted in the footnotes below, each of these persons had sole voting and investment power with respect to the common stock owned by him or her.

Name | Age | Director of Bancorp Since | Amount and Nature of Ownership of Common Stock | Percentage Ownership of Common Stock 1/ | ||||||||||||

Nominees for Election for the Term Ending in 2019 (Class II): | ||||||||||||||||

Kelly L. Chan | 69 | 1990 | 396,449 | 2/ | * | / | ||||||||||

Dunson K. Cheng***/ | 71 | 1990 | 1,229,810 | 3/ | 1.55 | % | ||||||||||

Thomas C.T. Chiu**/ | 68 | 2003 | 288,098 | 4/ | * | / | ||||||||||

Joseph C.H. Poon | 69 | 1990 | 56,725 | 5/ | * | / | ||||||||||

Directors Currently Serving for the Term Ending in 2017 (Class III): | ||||||||||||||||

Nelson Chung | 63 | 2005 | 28,285 | 6/ | * | / | ||||||||||

Felix S. Fernandez | 65 | 2013 | 4,785 | * | / | |||||||||||

Patrick S.D. Lee | 81 | 1990 | 231,515 | 7/ | * | / | ||||||||||

Ting Y. Liu | 79 | 2003 | 390,713 | 8/ | * | / | ||||||||||

Directors Currently Serving for the Term Ending in 2018 (Class I): | ||||||||||||||||

Michael M.Y. Chang | 78 | 1990 | 236,639 | 9/ | * | / | ||||||||||

Jane Jelenko | 67 | 2012 | 5,837 | 10/ | * | / | ||||||||||

Anthony M. Tang | 62 | 1990 | 1,099,854 | 11/ | 1.40 | % | ||||||||||

Peter Wu**/ | 67 | 2003 | 895,969 | 12/ | 1.14 | % | ||||||||||

Other Named Executive Officers: | ||||||||||||||||

Heng W. Chen | 63 | — | 105,817 | 13/ | * | / | ||||||||||

Pin Tai | 62 | — | 2,733 | 14/ | * | / | ||||||||||

Irwin Wong | 67 | — | 47,205 | 15/ | * | / | ||||||||||

Donald S. Chow | 65 | — | 0 | * | / | |||||||||||

All nominees, directors, and executive officers as a group (17 persons) | 5,034,197 | 16/ | 6.36 | % 17/ | ||||||||||||

Name | Age | Director of | Amount and | Percentage Ownership | ||||||||||||

Nominees for Election for the Term Ending in 2025 (Class II): | ||||||||||||||||

Kelly L. Chan | 75 | 1990 | 249,782 | 2/ | */ | |||||||||||

Dunson K. Cheng **/ | 77 | 1990 | 805,601 | 3/ | 1.07 | % | ||||||||||

Chang M. Liu **/ | 55 | 2020 | 21,236 | 4/ | */ | |||||||||||

Joseph C.H. Poon | 75 | 1990 | 67,033 | 5/ | */ | |||||||||||

Directors Currently Serving for the Term Ending in 2023 (Class III): | ||||||||||||||||

Nelson Chung | 69 | 2005 | 38,593 | 6/ | */ | |||||||||||

Felix S. Fernandez | 71 | 2013 | 15,093 | 7/ | */ | |||||||||||

Maan-Huei Hung | 74 | 2020 | 2,275 | 8/ | */ | |||||||||||

Richard Sun | 69 | 2017 | 37,623 | 9/ | */ | |||||||||||

Directors Currently Serving for the Term Ending in 2024 (Class I): | ||||||||||||||||

Jane Jelenko | 73 | 2012 | 7,302 | 10/ | */ | |||||||||||

Anthony M. Tang | 68 | 1990 | 989,601 | 11/ | 1.32 | % | ||||||||||

Shally Wang | 65 | 2021 | 0 | */ | ||||||||||||

Peter Wu | 73 | 2003 | 785,227 | 12/ | 1.05 | % | ||||||||||

Other Named Executive Officers: | ||||||||||||||||

Heng W. Chen | 69 | — | 155,061 | 13/ | */ | |||||||||||

Kim R. Bingham | 65 | — | 44,756 | 14/ | */ | |||||||||||

Mark H. Lee | 59 | — | 10,785 | 15/ | */ | |||||||||||

All nominees, directors, and executive officers as a group (15 persons) | 3,229,968 | 16/ | 4.30 | % 17/ | ||||||||||||

*/ | Percentage of shares beneficially owned does not exceed one percent. |

**/ |

|

A Named Executive Officer as well as a director. |

1/ |

|

2/ | Includes |

3/ | Includes |

4/ | Includes |

5/ | Includes 46,440 shares held by the Poon Family |

6/ | Includes 10,000 shares held by Nelson Chung Defined Benefit Plan, 10,000 shares held by |

|

|

|

|

|

8/ | Shares held jointly with spouse. |

| Includes |

10/ | Includes 2,116 shares held by the Jelenko-Norris Marital Trust and 5,186 shares held by the Jelenko-Norris Survivors Trust. |

11/ | Includes approximately 630,892 shares held by Mr. Tang’s spouse and |

12/ | Includes |

13/ | Includes |

14/ | Includes |

15/ | Includes |

16/ |

|

17/ | The ownership percentage is determined by dividing the number of shares beneficially owned by all our nominees, directors, and executive officers as a group by |

Nominees, Continuing Directors, and Executive Officers

Set forth below is information concerning each nominee for election as a Class II director, each of the Class III and I directors whose terms have not yet expired, and each other executive officer. Each of the current directors is also a director of Cathay Bank, a wholly-owned subsidiary of Bancorp. The biographical information set forth below includes the person’s principal occupation, business experience over the last five years, positions held, and the experience, qualifications, attributes, or skills that led the Nomination and Governance Committee and the Board to determine that the person should serve as a director. In addition, they each have satisfied other criteria considered by the Nomination and Governance Committee and the Board in evaluating potential nominees and directors, including intelligence, personal character, integrity, and commitment to the community and Bancorp.

Nominees (Class II)

Kelly L. Chan Independent | Director since 1990 Committees: Audit (Chair), Compensation, Nomination and Governance |

Kelly L. Chan is ana long-time owner of Phoenix Bakery Inc., a family-owned retail bakery that began in Los Angeles Chinatown and that has been serving the Los Angeles area for over 75more than 80 years. He retiredMr. Chan was reappointed as Vice President of Finance of Phoenix Bakery Inc. in 2012.2017 after retiring in 2012 from that position. Mr. Chan is a Certified Public Accountant with over 3040 years of experience, andexperience. He received a Master of Business Administration degree. Hedegree and served in the U.S. Navy from 1970 to 1973 and in the U.S. Naval Reserve until his retirement in 2000 with the rank of Captain. He has also been awarded certification by the UCLA Anderson Graduate School of Management’s Director Training and Certification Program. Mr. Chan has been a Director of Cathay Bank since 1981 and of Bancorp since it was formedits formationin 1990. Mr. Chan also serves as a holding company in 1990.member of the Cathay Bank Foundation Audit Committee.

With more than 40 years of retail business experience, Mr. Chan offers the Board substantial management experience withof privately held businesses, which constitute a significant portion of the customers of Cathay Bank. As a Certified Public Accountant, Mr. Chan adds additional expertise in accounting matters, and serves as chairman of the Audit Committee.

Dunson K. Cheng,Ph.D., Executive Chairman of Bancorp and Bank | Director since 1990 Committees: Investment, Risk |

Dunson K. ChengPh.D., has been the Executive Chairman of the Board of Bancorp and Cathay Bank since 2016. He was the Chairman of the Board, President, and Chief Executive Officer of Bancorp and Chairman of the Board and Chief Executive Officer of Cathay Bank since 1994. He wasfrom 1994 to 2016, and the President of Cathay Bank from 1985 to March 2015. Mr. Cheng has over 3039 years of banking experience. He also serves on the boardsboard of DiCon Fiberoptics, Inc. (a supplier of optical components, integrated modules, and test equipment for the fiber optics industry), and on the Foundation of Tsinghua Education Foundation (N.A.) Inc., and Ascencia (formerly known as PATH Achieve Glendale).University Center for Advanced Study. He formerly served on the board of directors of the California Bankers Association. Mr. Cheng received a Ph.D. in Physics. He has been a Director of Cathay Bank since 1982 and of Bancorp since it was formed as a holding companyits formation in 1990.

Mr. Cheng provides to the Board his extensive banking experience, his broad knowledge of the business and operations of Bancorp and Cathay Bank, and his strong management and leadership skills. His tenure as an officer and a director for over 30 years affords the Board valuable insight regarding all aspects of the business and operations of Bancorp and Cathay Bank.

Thomas C.T. Chiu, M.D., a medical doctor, had served as

Chang M. Liu President and CEO | Director since 2020 Committees: None |

Chang M. Liu has been the Chief Executive Officer and President of Bancorp and Chief Executive Officer of an independent physicians association, chairman of its governing board, and chair of various committees at a healthcare facility in Monterey Park, California. He had been a director of General Bank and its publicly-held bank holding company, GBC Bancorp, for 10 years until they merged with Cathay Bank since October 2020, and BancorpPresident of Cathay Bank since October 2019. Mr. Liu joined Cathay Bank in 2003. Dr. Chiu2014 as Senior Vice President and Assistant Chief Lending Officer. He was Senior Vice President and Deputy Chief Lending Officer of Cathay Bank from 2014 to 2015; Chief Lending Officer at Cathay Bank from 2016 to 2019; Executive Vice President of Cathay Bank from 2016 to October 2019; and Chief Operating Officer of Cathay Bank from February to September 2020. Prior to joining Cathay Bank, Mr. Liu was Executive Vice President and Chief Lending Officer at Banc of California (formerly known as “Pacific Trust Bank”) from 2011 to March of 2014. Mr. Liu has over 28 years of banking experience. He currently serves on the board of the Foothill Family Service and the Western Bankers Association. Mr. Liu has been a Director of Bancorp and Cathay Bank since 2003.2019 and of Bancorp since October 2020.

Dr. Chiu

Mr. Liu is a well-respected medical doctor in Southern California. He has been extensively involved with a multi-language/multi-cultural healthcare facility in Monterey Park, California, a community that has a large Chinese-American population. He is an active participant inseasoned banker and brings to the Chinese-American community, which is served by Cathay Bank. He also provides institutionalBoard in-depth management and operational knowledge of the history and operations of GeneralCathay Bank and GBCthrough his leadership role at the Bancorp.

Joseph C.H. Poon Independent | Director since 1990 Committees: Nomination and Governance (Chair), Compensation, Investment |

Joseph C.H. Poon is the President of Edward Properties, LLC, a real estate development company that specializes in residential, industrial, and commercial projects, and he has over 30 years of experience in real estate development. He received a Master of

Business Administration degree and a Master of Science degree in Civil Engineering. Mr. Poon has been a Director of Cathay Bank since 1981 and of Bancorp since it was formed as a holding companyits formation in 1990. He served as the Lead Independent Director of Bancorp from July 2010 to May 2011.

Mr. Poon provides the Board with considerable managerial experience, as well as anhis extensive backgroundknowledge in commercial, industrial, and residential real estate construction and development. He also contributes his academic background in business and engineering.

Continuing Directors (Class III)

Nelson Chung Lead Independent | Director since 2005 Committees: Risk |

Nelson Chungis President of Pacific Communities Builder, Inc., which has built more than 4,000 home sites and developed more than 150 communities in Southern California. He received a Master of Urban Design degree and is a licensed architect, general contractor, and real estate broker in California.

Mr. Chung has been a Director of Bancorp and Cathay Bank since 2005.2005 and has been a Lead Independent Director of Bancorp since May 2017.

Mr. Chung contributes managerial experience and anhis extensive knowledge of residential real estate development in Southern California, with which he has been involved for over 30 years. His academic background in urban design and his experience as an architect, general contractor, and real estate broker provide the Board with a unique perspective of the real estate market.

Felix S. Fernandez Independent | Director since 2013 Committees: Investment (Chair), Audit, Risk |

Felix S. Fernandezhas served as a leader at Wells Fargo in various capacities for over 15 years. In 2011, he retired as a Corporate Executive Vice President and Regional President of Community Banking for Wells Fargo in the Northern California region,region. He was responsible for up to 150 branches, $15 billion in deposits and $1.5 billion in loans, and 2,700 employees. Prior to working at Wells Fargo, Mr. Fernandez served as Executive Vice President of International Business Banking at State National Bank in El Paso, Texas, where he was responsible for the Mexico business market, and also served in various positionscapacities at Valley National Bank of Arizona (later a part of Chase Bank). Mr. Fernandez has been active in the community and business organizations throughout his career, including affiliations with the United Way, Boys and Girls Club of America, Boy Scouts of America, Bankers Association for Finance

and Trade, and the Greater Sacramento Chamber of Commerce. He also served on the board of Sacramento State University Enterprise, Inc., Dignity Health Sacramento Service Region Board, Crocker Art Museum, and the California Bankers Association. He currently serves on the board ofAssociation, and Pan American Bank. He received a Master of Business Administration degree, with an emphasis in Finance. Mr. Fernandez has been a Director of Bancorp and Cathay Bank since 2013.

Mr. Fernandez brings with him valuable financial skills and diverse experience, along with a leadership record in the banking industry, all of which enhance ourthe Board’s capacity to guide our future growth and development.

Patrick S.D. Lee

Maan-Huei Hung Independent | Director since 2020 Committees: Compensation, Nomination and Governance |

Maan-Huei Hung is the founderGeneral Counsel for AHMC Healthcare Inc., a Southern California based company that owns and former Presidentoperates eight hospitals. Ms. Hung is an attorney licensed to practice in California with over 40 years of T.C. Construction Corporation, a company involved in the construction and development of commercial and residential real estate in the greater Los Angeles area. Mr. Lee is activeexperience in the Los Angeles Chinese-American communityarea and currently serves as a director of the Chinatown Service Centerpractices transactional corporate law with an emphasis in banking and as an advisor on the Chinese Chamber of Commerce. He has been a Director of Cathay Bank Foundation since 2004. He received a Bachelor of Science degree in Civil Engineering, and has been licensed as a structural engineer, civil engineer, and general contractor. Mr. Lee has been a Director of Cathay Bank since 1983 and of Bancorp since it was formed as a holding company in 1990. He has been serving as the Lead Independent Director of Bancorp since May 2011.

Mr. Lee provides the Board with considerable managerial experience,commercial law as well as extensive experience in commercial and residential real estate construction and development in the Los Angeles area. His active involvement in civic organizations within the Chinese-American communityhealthcare laws. She served by Cathay Bank, as well as his tenure as a director, provides valuable insight regarding its business and operations.

Ting Y. Liu,Ph.D., was a co-founder and a director ofGeneral Counsel for General Bank and its publicly-held bankpublic holding company GBC Bancorp until they mergedits 2003 merger with Cathay Bank and BancorpCathay General Bancorp. She has also advised numerous financial and other non-financial institutions, both foreign and domestic, on management matters and legal and regulatory compliance associated with doing business in 2003. Mr. Liu was an aerospace research scientist for over 12 years,the U.S. She has been a real estate developer of motelsconsultant for financial and hotels,healthcare clients on strategic opportunities and co-founded Western Underwriter, an insurance

company, in 1985. He also co-founded the Southern California Hotel/Motel Association in the early 1980sactivities, and was active in the Holiday Inn Franchisee Association where hefrom 1978 to 1988, has served as corporate in-house counsel in securities laws and corporate finance with Litton Industries, Inc. (which later merged with Northrop Grumman Corporation).

Ms. Hung is a founding member and former president of the regional committeeTaiwanese American Lawyers Association. She was formerly a member for many terms. Mr. Liu receivedof the Financial Institutions Committee of the State Bar of California and a Ph.D. in Aerospace Science. Hemember of the board of the International Bankers Association of California. She has served as legal counsel to the National Association of Chinese American Bankers since 2002 and a board member on the AHMC Health Foundation. Ms. Hung holds law degrees from the National Taiwan University and Yale University. Ms. Hung has been a Director of Bancorp and Cathay Bank since 2003.May 2020.

Mr. Liu’s

With extensive legal experience, in commercial real estate development provides a valuable perspective onMs. Hung brings her legal expertise and her ability to analyze issues that contribute to the real estate market,Board's oversight and his background in the insurance business providesguidance for our growth and development. The Board also benefits from her knowledge of the insurance market. His previous serviceand insight having served as a director ofGeneral Counsel for GBC Bancorp and General Bank and having worked with various types of business clients. In addition, Ms. Hung's community involvement provides additional commercial bankingher with knowledge and understanding of the communities that Cathay Bank serves, and her cross-industry and cross-cultural knowledge and experience is an asset to the Board.

Richard Sun Independent | Director since 2017 Committees: Compensation (Chair), Audit, Nomination and Governance |

Richard Sun is the President of SSS Development, Inc., a real estate investment, development, and management company.

Dr. Sun received his D.D.S. in Dentistry in 1982 and practiced for 18 years. He also served as the Mayor for the City of San Marino, California from 2012-2013, 2016-2017 and the city’s Council Member from 2009 to 2017. Dr. Sun has over 30 years of experience in real estate investment and 10 years of experience serving on the boards of financial institution experience.

Continuinginstitutions. Simultaneously, he served in numerous leadership and management roles including his directorships on Trust Bank Board of Directors (Class I)

Michael M.Y. Changfrom 1995 to 2004 and on Omni Bank Board of Directors from 2008 to 2009. He has been awarded certification by the UCLA Anderson Graduate School of Management’s Director Training and Certification Program. Dr. Sun is a retired attorney, having practiced law incommunity leader and has many years of civic service. He served on the Board of Governors of the Los Angeles County Natural History Museum from 2003 to 2017, as President of the Chinese American Elected Officials from 2015 to 2017, as a Committee Member of both the Economic Development Committee for 30 years until retiringMonterey Park and the Design Review Committee for San Marino from 2001 to 2004, and Board Member of the Workforce Investment Committee for Los Angeles County from 2000 to 2002. He also served on the Methodist Hospital Foundation Board from 2007 to 2016 and chaired the foundation in 2000. He was2013.

Dr. Sun currently serves as a board member of the SecretaryCathay Bank Foundation and is an emeritus board member of the Methodist Hospital Foundation.

Dr. Sun has been a Director of Bancorp and Cathay Bank from 2001 to August 2010. Mr. Chang was one of the founders of the Southern California Chinese Lawyers Association.since 2017. He formerly served as a director of Chinatown Service Center, a community-based Chinese-American health and human services organization in Southern California. He received a Juris Doctor degree and a Bachelor of Science degree in Accounting. Mr. Chang has been a Director of Cathay Bank since 1983 and of Bancorp since it was formed as a holding company in 1990.

Mr. Chang has been a well-respected attorney in Los Angeles for over 30 years,brings with the emphasis of his practice being in areas of business law, real estate, corporations, and taxation. The Board benefits from his legal experience and analysis of issues. His participation in the Chinese-American community in Southern California provides knowledge of the local economy,him board experiences at financial institutions as well as business opportunities for Cathay Bank.his depth of knowledge and experience in both public and private companies. The Board believes that his diversified skills add valuable entrepreneurial, managerial, and leadership perspectives to the Board.

Continuing Directors (Class I)

Jane Jelenko Independent | Director since 2012 Committees: Risk (Chair), Audit, Nomination and Governance |

Jane Jelenko was a partner at KPMG LLP, a global audit, tax, and advisory services firm, where she became the first female consulting partner in 1983, and served over 25 years (from 1977 to 2003) in various capacities including the National Industry Director for its Banking and Finance group, a member of the firm’s Boardboard of Directors,directors, and the leader for the firm’s Banking and Investment

Services Consulting group. She has also served on the Countrywide Bank board (Audit and Operations Committees), the Los Angeles Area Chamber of Commerce Executive Committee, and the Organization of Women Executives board. She currently serves on the boardsboard of two SunAmerica Mutual Funds families, and on non-profit boards, including the United States Holocaust Memorial Museum, the Center Dance Arts of the Los Angeles Music Center, Dizzy Feet Foundation, Body Traffic,the American Dance Movement, The Gabriella Foundation, and the Constitutional Rights Foundation (emeritus). She received a Master of Business Administration degree in Finance. Also, she has been awarded certification by the UCLA Anderson Graduate School of Management’s Director Training and Certification Program. Ms. Jelenko has been a Director of Bancorp and Cathay Bank since January 2012.

Ms. Jelenko brings a fresh perspective as a recently elected member ofto the Board along with her extensive managerial and finance experience and community service.

Anthony M. Tang Vice Chairman | Director since 1990 Committees: None |

Anthony M. Tang has been Vice Chairman of the Board of Bancorp and Cathay Bank since August 21, 2014 and has over 30 years of banking experience. He was an Executive Vice President of Bancorp from 1994 to September 2013, Senior Executive Vice President of Cathay Bank from 1998 to 2013, Chief Lending Officer of Cathay Bank from 1985 to September 2013, and Executive Vice Chairman of the Board of Bancorp and Cathay Bank from October 2013 to August 20, 2014. Mr. Tang was formerly the Chief Financial Officer and Treasurer of Bancorp from 1990 to 2003. He received a Master of Business Administration degree. Mr. Tang has been a Director of Cathay Bank since 1986 and of Bancorp since it was formed as a holding companyits formation in 1990.

Through his service to Cathay Bank in various capacities for over 25 years, Mr. Tang brings to the Board an in-depth knowledge and understanding of its history and business, as well as his extensive knowledge of its operations including from a financial and accounting standpoint.

Shally Wang Independent | Director since 2021 Committees: None |

Shally Wang has served in various capacities at IBM Greater China Group for 34 years, leading key business units under global business services, information technology services, financial services sector, industry solutions and key industry clients. With a background in systems engineering, she was responsible for building organization competency across IBM Greater China Group in project management, application development methodology, enterprise systems architecture and governance, and banking industry solutions and business operations. In 2017, Ms. Wang retired as the General Manager of IBM Greater China Group. She currently serves as a Group Senior Advisor for Digital China Information Service Company, a leading information technology company in China that focuses on digital transformation in the banking sector. Ms. Wang has been a frequent keynote speaker on issues involving the banking and technology sectors at the annual China Banking Show. She holds two Master of Science degrees, in Mathematics and in Computer Science. Ms. Wang has been a Director of Bancorp and Cathay Bank since May 2021.

Ms. Wang brings to the Board her experience as a leader of a major technology company, her expertise in information technology, information security experience in the financial sector, and insights on doing business in China.

Peter Wu, Ph.D. Vice Chairman

|

Peter Wu, Ph.D., has been Vice Chairman of the Board of Bancorp and Cathay Bank since 2014, and a Director, Chairman of the Board, President, and Chief Executive Officer of Cathay Bank Foundation since 2005. He was Chief Operating Officer of Bancorp and Cathay Bank from 2003 to 2014, and Executive Vice Chairman of the Board of Bancorp and Cathay Bank from 2003 to 2014. He was the Chairman of the Board of GBC Venture Capital, Inc. from 1997 to 2014 and President and Chief Executive Officer of GBC Venture Capital, Inc. from 2003 to 2014. Prior to joining Bancorp, Mr. Wu was a co-founder, Chairman of the Board, President, and Chief Executive Officer of General Bank and its publicly-held bank holding company, GBC Bancorp, until they merged with Cathay Bank and Bancorp in 2003. Mr. Wu received a Ph.D. in Mathematics. He has been a Director of Bancorp and Cathay Bank since 2003.

Mr. Wu provides commercial banking and managerial experience to Bancorp and Cathay Bank gained from his executive management positions with GBC Bancorp and General Bank, of which he was a co-founder, and then Bancorp and Cathay Bank. He also provides institutional knowledge of the history and operations of General Bank and GBC Bancorp.

Executive Officers

Heng W. Chen Chief Financial Officer |

Heng W. Chen has been Executive Vice President, Chief Financial Officer, and Treasurer of Bancorp and Executive Vice President of Cathay Bank since 2003, and Chief Financial Officer of Cathay Bank since 2004. He was Vice President and Chief Financial Officer of Cathay Real Estate Investment Trust from 2003 to 2013 and has been a Director, Vice President, and Chief Financial Officer of GBC Venture Capital, Inc. since 2003. Prior to joining Bancorp, Mr. Chen had over 25 years of experience in the areas of finance, accounting, and banking at City National Bank, and its publicly-held bank holding company, City National Corporation, and at Price Waterhouse. Mr. Chen was formerly a Certified Public Accountant and received a Master of Business Administration degree.

Pin Taihas been President and a Director of Cathay Bank since April 1, 2015. Mr. Tai joined Cathay Bank in 1999 as General Manager of New York Regions with a goal to establish our footing in the East Coast region. In 2006, Mr. Tai became Executive Vice President and the General Manager of Eastern Regions, and then became the Deputy Chief Lending Officer in 2010 and the Chief Lending

Officer in 2013. He has also been a Director of Cathay Bank Foundation since 2004. Mr. Tai has over 32 years of banking experience. Prior to joining Cathay Bank, Mr. Tai worked at Bank of China in its New York office to help establish its commercial lending operations in the United States.

Irwin Wong has been Senior Executive Vice President of Cathay Bank since 2014 and Chief Operating Officer of Cathay Bank since April 1, 2015. Mr. Wong joined Cathay Bank in 1988 as Vice President of Branch Administration, advanced to Senior Vice President of Branch Administration in 1989, served as Executive Vice President of Branch Administration from 1998 to 2011 and as Executive Vice President and Chief Risk Officer from 2011 to 2013, and as Chief Retail Administration and Regulatory Affairs Officer from January 2014 to March 2015. He has also been a Director of Cathay Bank Foundation since 2002, and Chief Financial Officer/Treasurer of Cathay Bank Foundation from 2004 to 2011. Mr. Wong has over 35 years of banking experience. Mr. Wong is active in community organizations and serves as a director of Junior Achievement of Southern California, the California Council on Economic Education, and the Los Angeles Nashi Hongwanji Buddhist Temple.

Donald S. Chow has been an Executive Vice President and Chief Credit Officer of Cathay Bank since January 2014. Mr. Chow joined Cathay Bank in August 2013 as a Consultant of the Office of the President. Prior to joining Cathay Bank, Mr. Chow was Executive Vice President and Senior Supervisor at East West Bank from 2009 to 2013 and President of Desert Community Bank, a Division of East West Bank, from 2007 to 2009. Mr. Chow has over 25 years of banking experience in the areas of credit and commercial lending.

Kim R. Bingham has been an Executive Vice President of Cathay Bank since 2004 and Chief Risk Officer of Cathay Bank since January 2014. Mr. Bingham joined Cathay Bank in 2004 as Chief Credit Officer and served in that capacity until December 2013. Prior to joining Cathay Bank, Mr. Bingham managed Private Banking for Mellon Bank in the Western United States and prior to this position, Mr. Bingham served in a series of increasingly responsible staff and management positions in lending and credit for City National Bank. Mr. Bingham has more than 30 years of banking experience.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

|

Kim R. Bingham has been an Executive Vice President of Cathay Bank since 2004 and Chief Risk Officer of Cathay Bank since 2014. Mr. Bingham joined Cathay Bank in 2004 as Chief Credit Officer and served in that capacity until December 2013. Prior to joining Cathay Bank, Mr. Bingham managed Private Banking for Mellon Bank in the Western United States and prior to this position, Mr. Bingham served in a series of increasingly responsible staff and management positions in lending and credit for City National Bank. Mr. Bingham has more than 30 years of banking experience.

Chief Credit Officer

|

Mark H. Lee is the Executive Vice President and Chief Credit Officer of Cathay Bank. Mr. Lee joined Cathay Bank in April 2017 as Executive Vice President, Special Advisor to the Office of the President and was appointed as the Chief Credit Officer of Cathay Bank in December 2017. Mr. Lee has more than 30 years of banking experience and provides leadership and support to the Credit Administration function at Cathay Bank.

Prior to joining Cathay Bank, Mr. Lee held senior leadership roles in credit administration and loan review, loan operations, and asset based lending. He was the Senior Executive Vice President and Head of Corporate Banking of Bank of Hope (formerly known as BBCN Bank) from 2016 to 2017; Senior Executive Vice President and Chief Credit Officer of BBCN Bank (formerly known as Nara Bank) from 2009 to 2016; and Senior Vice President and Deputy Chief Credit Officer of East West Bank from 2007 to 2009.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business and affairs are managed under the direction and oversight of the Board. The Board is committed to maintaining the highest standards of business conduct and corporate governance. The Board has adopted Corporate Governance Guidelines, which, together with our certificate of incorporation, bylaws, Code of Ethics, and Board committee charters, form the framework for the governance of Bancorp. The Corporate Governance Guidelines, Code of Ethics and Board committee charters are available at www.cathaygeneralbancorp.com.

The Board generally holds regular meetings every other month. Special meetings are called when necessary. During 2021, the Board held seven meetings. In 2021, each director attended more than 75% of the aggregate of (i) the total number of meetings of the Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of the Board on which he or she served during the periods that he or she served. It is our policy to invite and encourage all members of the Board to attend Bancorp’s annual meeting of stockholders. All of our directors attended the 2021 annual meeting of stockholders.

Dunson K. Cheng leads the Board in his role as the Executive Chairman of the Board.

The Chairman of the Board sets the agendas, presides at Board meetings, and generally takes the lead role in the boardroom. In the absence of the Chairman of the Board, a Vice Chairman presides at Board meetings. Any director may suggest the inclusion of items on the agenda and raise at any Board meeting subjects that are not specifically on the agenda for that meeting.

The Chairman of the Board can be designated by the Board as the Chief Executive Officer or the Executive Chairman. The Board does not require the separation of the offices of the Chairman of the Board and the Chief Executive Officer. The Board recognizes no single leadership model is right for all companies and at all times. The Board believes it is important to maintain flexibility in its Board leadership structure depending on the needs of Bancorp.

The Board believes that separating the roles of the Chief Executive Officer and Chairman of the Board is the most appropriate structure for Bancorp at this time. The Board believes that this structure provides clarity of leadership following the appointment of Mr. Liu as Chief Executive Officer of Bancorp on October 1, 2020, and that Mr. Cheng is uniquely qualified through his experience and expertise to continue leading Bancorp in his capacity as the Executive Chairman.

Moreover, the Board recognizes that managing the Board can be a separate and time intensive responsibility. By separation of the roles of Chief Executive Officer and Chairman of the Board, it allows Mr. Liu to devote his full attention to the supervision, management and control of the business and affairs of Bancorp and Cathay Bank, without the additional responsibilities of Chairman of the Board. The Board also believes that having a separate Chairman of the Board allows Bancorp to continue to benefit from Mr. Cheng’s vast organizational, business and industry experience and expertise in his role as Executive Chairman and from the business synergies and mentoring opportunities.

In accordance with our Corporate Governance Guidelines, if the Chairman of the Board is an employee, or not independent, an independent director shall be elected by the independent directors to serve as the Lead Independent Director.

The Lead Independent Director is elected by the majority of independent directors on an annual basis at the first executive session after the annual stockholders’ meeting, and is charged with the following responsibilities:

Presiding at meetings of the independent directors in executive session;

Facilitating communications between other members of the Board and the Chairman of the Board and/or the Chief Executive Officer; and

Consulting with the Chairman of the Board and/or the Chief Executive Officer on matters relating to corporate governance and Board performance.

Currently, Nelson Chung serves as the Lead Independent Director.

The Board also accomplishes much of its governance and oversight role through its Audit, Compensation, Nomination and Governance, and Risk Committees that, with the exception of the Risk Committee, are made up entirely of independent directors. The chairs of these committees take the lead in matters coming within their purview. In addition, the independent directors meet at least quarterly in executive session. Finally, the Chairman of the Board serves at the pleasure of the Board, and the independent members of the Board (constituting a majority of the directors) can call special meetings if the need arises. The Board believes that Bancorp’s approach to risk oversight helps to ensure that the Board can choose different leadership structures as appropriate without experiencing a material impact on its oversight or risk.

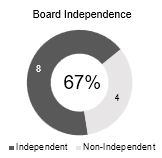

Our Corporate Governance Guidelines provide that the Board shall be comprised of a majority of directors who, in the opinion of the Board, qualify as “independent directors” pursuant to the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”). An “independent director” for purposes of the Guidelines means a person other than: (i) an executive officer or employee of Bancorp or its subsidiaries, or (ii) any other individual having a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board considered relationships, transactions, and/or arrangements with each of its directors, including those disclosed below under “Transactions with Related Persons, Promoters and Certain Control Persons,” and determined that the following eight of its current 12 members are “independent” as defined in the Nasdaq Stock Market Rules: Kelly L. Chan, Nelson Chung, Felix S. Fernandez, Maan-Huei Hung, Jane Jelenko, Joseph C.H. Poon, Richard Sun, and Shally Wang.

In addition, the Board has determined that:

All directors who serve on the Audit, Compensation, and Nomination and Governance Committees are independent under applicable Nasdaq listing standards and SEC rules; and

All members of the Audit and Compensation Committees meet the additional independence requirement that they do not directly or indirectly receive any compensation from Bancorp or Cathay Bank other than their compensation as directors.

The independent directors meet in executive session without the presence of any members of Bancorp’s management on a regularly scheduled basis, but not less than four times a year. In 2021, the independent directors met in executive session six times.

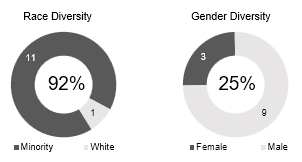

The Board values the importance of diversity among its members. A board comprised of members from a diverse professional and personal background brings distinct veiwpoints and perspectives that can effectively represent the long-term interest of our stockholders. The following summarizes some of the key experience, qualifications, skills, and attributes possessed by our Board of Directors.

Leadership experience in holding significant leadership roles over an extended period of time provides the Company with unique insights.

Business Operations experience gives directors a practical understanding of development, implemention, and assessment of the Company’s operating plan and business strategies.

Finance includes financial expertise and literacy that is important as it assists the directors in understanding and overseeing the Company’s financial reporting and internal controls.

Risk Management experience is critical to the Board’s role in overseeing the risks facing the Company.

Real Estate experience is crucial in understanding and reviewing the Company’s business and strategies in lending and investments.

Inclusion and diversity are the cultural hallmarks of the Company. We believe that a diverse mix of directors with complementary qualifications, expertise, and attributes brings diverse perspectives that reflects on strong Board practices contributing to the overall oversight responsibility.

Our 12-member Board of Directors consist of 11 members of minority descent and a quarter of the Board seats are held by women.

The Board is responsible for the oversight of risk management, and it looks to Bancorp’s and its subsidiary Cathay Bank’s management to develop and implement policies, processes, and procedures to appropriately identify, manage, and control risk exposure. The Board’s function is, among other things, to review these policies, processes, and procedures and determine whether they are aligned and integrated with the Board’s corporate strategy and risk tolerance, functioning appropriately, and adequately fostering a culture of risk-adjusted decision making within the organization.

In its oversight role, the Board relies to a large extent on its committee structure. Each of the committees considers the management of risk within the particular area of its responsibility. For example, the Compensation Committee has responsibility for monitoring the performance, and regularly reviewing the design and function of our incentive compensation plans and arrangements and seeks to ensure that they do not encourage executive officers to take unnecessary and excessive risks that threaten our value and do not encourage the manipulation of reported earnings to enhance the compensation of any employee. Separately, the Audit Committee oversees activities performed by the audit and loan review functions of Bancorp. The Chief Internal Auditor of Cathay Bank reports on audit matters directly to Cathay Bank’s Audit Committee, which also evaluates the performance of the Chief Internal Auditor. The Board has delegated the general responsibility for overall risk management oversight to the Risk Committee. The Risk Committee meets periodically with the Chief Risk Officer.

Risk management oversight is also provided through an internal committee of Cathay Bank, which is chaired by Cathay Bank’s Executive Vice President and Chief Risk Officer. This group meets at least quarterly and is responsible for evaluating relevant risk information, implementing appropriate strategies to address risks, and reporting the results to executive management, the Risk and Compliance Committee of the Cathay Bank Board of Directors, the Risk Committee, and the Board.

The Board receives regular reports from its committees, including the Risk Committee, regarding their deliberations and actions, as well as a quarterly report from the Chief Risk Officer of Cathay Bank, and regularly discusses and evaluates the risks we are facing and the effectiveness of actions being taken to monitor and control exposure from such risks. In addition, the independent directors meet at least annually in executive session with Cathay Bank’s Chief Risk Officer, Cathay Bank’s Chief Internal Auditor, and representatives of Bancorp’s independent registered public accounting firm.

The directors of Bancorp are also the directors of Cathay Bank and members of certain of its committees. The Board has five standing committees: Audit Committee, Compensation Committee, Investment Committee, Nomination and Governance Committee, and Risk Committee. Each of these committees has adopted a written charter of which is available on our website at www.cathaygeneralbancorp.com. The following table identifies the current committee membership and the number of meetings held in 2021:

Name | Audit | Compensation | Investment | Nomination | Risk | |||||||||||||||

Kelly L. Chan | Chair | X | X | |||||||||||||||||

Dunson K. Cheng | X | X | ||||||||||||||||||

Nelson Chung | X | |||||||||||||||||||

Felix S. Fernandez | X | Chair | X | |||||||||||||||||

Maan-Huei Hung | X | X | ||||||||||||||||||

Jane Jelenko | X | X | Chair | |||||||||||||||||

Chang M. Liu | ||||||||||||||||||||

Joseph C.H. Poon | X | X | Chair | |||||||||||||||||

Richard Sun | X 1/ | Chair | X 1/ | |||||||||||||||||

Anthony M. Tang | ||||||||||||||||||||

Shally Wang | ||||||||||||||||||||

Peter Wu | X | X | ||||||||||||||||||

Number of Committee Meetings Held in 2021 | 9 | 8 | 2 | 5 | 6 | |||||||||||||||

|

1/

The Audit Committee oversees Bancorp’s financial reporting on behalf of the Board. It appoints and evaluates Bancorp’s independent auditors, and reviews with the independent auditors the proposed scope of, fees for, and results of the annual audit. It reviews the system of internal accounting controls and the scope and results of internal audits with the independent auditors, the internal auditors, and Bancorp management. It considers the audit and non-audit services provided by the independent auditors, the proposed fees to be charged for each type of service, and the effect of non-audit services on the independence of the independent auditors.

As provided by its charter, the Audit Committee is comprised of three or more directors, and its members must meet the Nasdaq listing standards, the regulations of the SEC, and the requirements of the Federal Deposit Insurance Corporation.

All members of the Audit Committee are “independent” as defined in the Nasdaq listing standards. The Board conducted a review regarding whether any members of the Audit Committee meet the criteria to be considered an “audit committee financial expert” and determined that Mr. Chan, its Chairman, and Ms. Jelenko each qualifies as an “audit committee financial expert,” as defined in Item 407(d)(5) of the SEC’s Regulation S‑K.

Although the Audit Committee does not have a policy for pre-approving services to be provided by Bancorp’s independent auditors, all services to be provided to Bancorp by its independent auditors are subject to review and approval by the Audit Committee in advance of the performance of the services, provided that the Audit Committee will not approve any non-audit services proscribed by Section 10A(g) of the Exchange Act in the absence of an applicable exemption. The Audit Committee may delegate to a designated member or members of the Audit Committee the authority to approve such services so long as any such approval is reported to the full Audit Committee at its next scheduled meeting. The Audit Committee has not delegated such authority.

The purpose of the Compensation Committee is to exercise oversight with respect to the compensation philosophy, policies, practices, and implementation for our executive officers and directors, the administration of our equity-based compensation plans, and the administration of our incentive and other plans for our executive officers. In addition to its risk management responsibilities as described above, the Compensation Committee has responsibility for: (a) establishing our compensation policies and practices with regard to our Chief Executive Officer and the other executive officers; (b) reviewing and approving, at least annually, goals and objectives with respect to the performance of our Chief Executive Officer and the other executive officers; (c) evaluating, at least annually, the performance of our Chief Executive Officer and the other executive officers in light of the corporate goals and objectives and the performance evaluations; and (d) administering our equity-based compensation plans, including making awards and determining the terms and conditions of awards.